Are you looking at your finances and wondering how to build wealth? How you can build a better portfolio? You’ve landed on the right page.

Financial advice has become increasingly more accessible in this day and age. There are many social media accounts dedicated to how to build wealth, how to get rich… however you might also feel like you’re being pulled into different directions. It’s a bit like medicine, no? You can go to three different physicians and get three different opinions making you more confused.

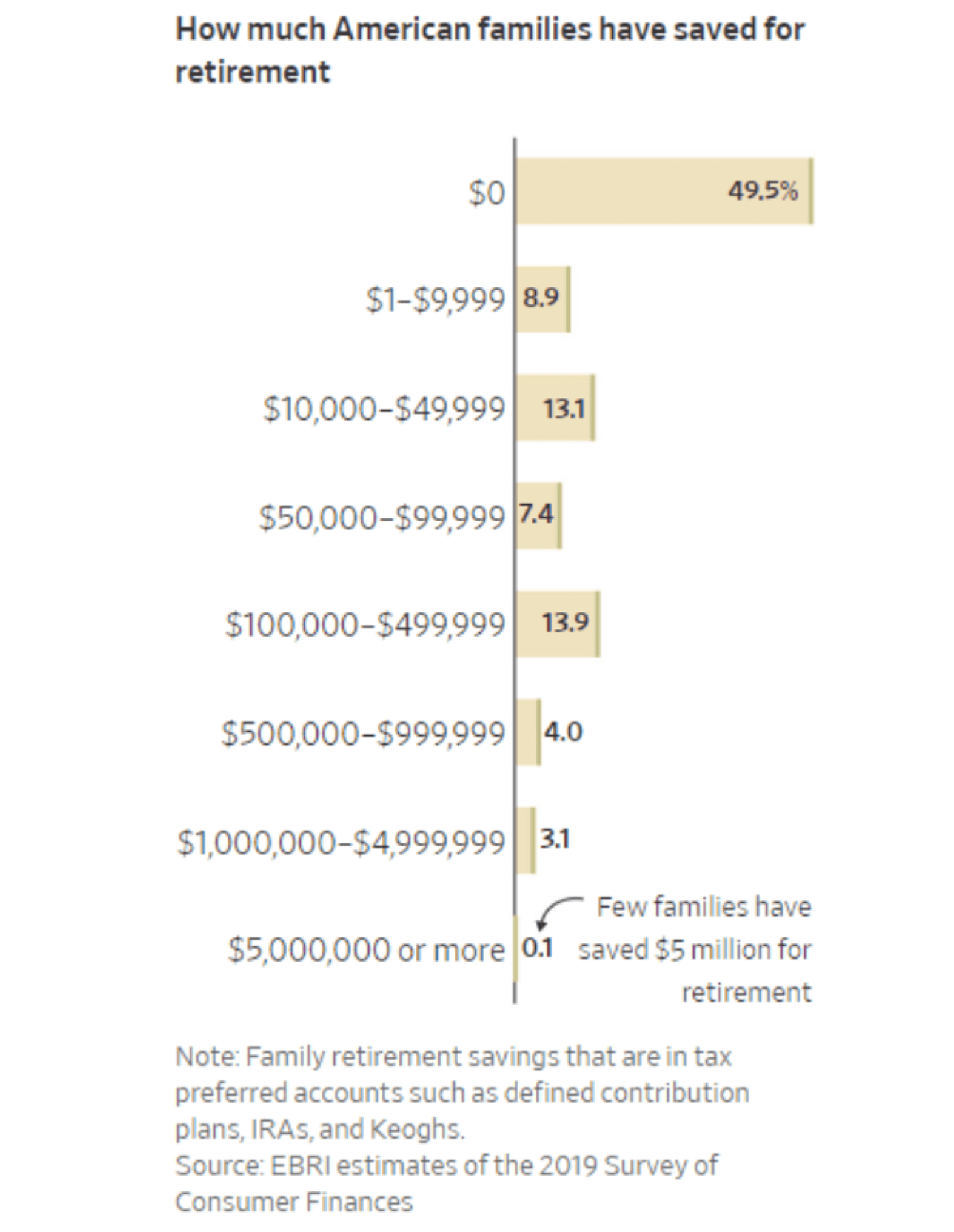

Some concerning stats for you: 50% of American families have no retirement funds set aside. And almost 80% have less than 500,000 USD published by the WSJ. More stats for you in this article. I share this with you with the hope that you do not develop a mental block as you are reading this. You also shouldn’t work on all of these steps simultaneously! Pick 1-2 and reassess per quarter.

BUT REALLY, HOW DO YOU BUILD WEALTH FROM NOTHING?

Almost everyone has a different opinion on what to do and where to start. So, I want to start off this blog post by saying that I am not a financial advisor or certified professional in this matter, but I have been reading about personal finance through a variety of books, the Harvard business review and Forbes for many years now. I also have a financial advisor myself to help me figure things out.

One of my favorite thoughts about money was written by Morgan Housel in the Psychology of Money. He basically says that every person based on what generation they belong to (boomers vs Gen Z), what their parents’ socioeconomic status was, where they lived, what different job markets and what type of luck they had, learn very different lessons on money and ultimately develop a different relationship with money. This couldn’t be more true and simple. I say this because as much as I want you to have an open mind, and educate yourself about building wealth, at the end of the day you are the one who may lose sleep at night over worrying when going against your gut. It is your money, so do what makes you feel comfortable.

Alright, now that we got that out of the way, let’s dive into this blog post where I talk about 13 steps on how to build wealth.

#1 ASSESS YOUR FINANCES

Grab a pen and paper (or an excel sheet) and write down all your assets and your debts. For assets, it will be everything you own, all of your bank accounts with their balances, your car’s market value, real estate you own, 401 (k), etc… your debts will be your loans, mortgages, and student loans etc. And that is how you will know your net worth. Assets – debt = net worth. I like to start off with this because you may not realize how big your debt is, or you may not realize how many assets you have that perhaps aren’t necessary in your every day life.

#2 EVALUATE YOUR INCOME

Evaluate your income means thinking whether you’re making enough as a total income, but also whether your employer is compensating you enough for the job that you do. For the ladder, it’s an email or one on one conversation about what you bring to the table and how much you should be compensated instead. A market analysis can come in handy when talking about numbers. For the former, if you are early in your career, in your 20’s, you most likely don’t make a lot, so you have to think about smart lifelong decisions to increase your income.

#3 STUDY YOUR SPENDING HABITS

Now the tough part, your expenses. Where is your money going? If you don’t know, reviewing a few credit card statements will reveal that to you. You need to find out of the box strategies on how to reduce your expenses. No one loves the idea of having a roommate, but if that’s one way to cut back on rent, so be it. Do you take frequent trips to Anthropologie and stock up on candles you don’t really need? Whatever it may be learn your patterns of spending money. Then have a plan for how you’re going to address those. Maybe learning how to make 5 delicious meals is what it’s going to take for you to save 2000 USD/ month, instead of spending it on Grubhub (I actually know people who do this). Maybe if you stopped ‘browsing’ in stores so much you would realize how much easier it is to save money when you’re not tempted.

#4 BUDGET & MAKE A PLAN

Here is where you make some decisions about the amount you want to save on a monthly basis and how to accomplish that. You must start by deciding how much of your post-tax income you want to save minimum 10%, hopefully 20%. Next step, you work your way towards allocating a budget for each category of your expenses; groceries, eating out, transportation including the occasional taxis, shopping, etc. This is where you’re going to decide on your changes in lifestyle and priorities. Perhaps you decide to move to a smaller apartment or a different neighborhood. Try spending money only on what you need for six months and see what that does to your finances.

#5 LEARN TO BE FRUGAL & LIVE BELOW YOUR MEANS

Learn to be frugal can mean different things to different people because we all have a certain understanding of what bare minimum means and what our lifestyles should look like. So, whatever that may be, think about ways to save. Whether it’s a new way of living that you’re leaning or it’s a short-term change. Learn to spend less and live below your means. We spend differently when our income grows, and we forget how we lived just fine when we made 30-40% less. I know physicians who continue to drive the same car five years post-graduation from fellowship training, because they are focused on paying off debt or simply want to save. Your savings in your 20s and 30s will go a long way.

Property of the Wall Street Journal.

#6 PAY OFF HIGH INTEREST DEBT

I’m not talking about your mortgage here. Mortgages are usually low interest and a smart decision. We are talking credit card debts. Usually anything more than seven percent interest is considered high interest. There are numerous ways to handle these. Especially if you have a large sum or multiple credit cards debts, you might want to work with a credit counselor or a debt settlement agency that can pay off your debt, and in return you pay them a certain amount (fee included). These companies make it possible for you to pay off your debt, rather than continuing to accrue compounding interest. People who do this pay less to close off their debt. You may also do this entirely on your own, with other approaches such as closing off debt with the highest interest rate first (smart decision) or closing the debt with the smallest amount and moving up in order to consolidate. Whatever you do, working to pay off debt is vital for your financial health.

#7 EMERGENCY FUND

Emergency funds are so important. While it is true that you never know when you can lose your job and having savings to rely on can be lifesaving; the benefit of the emergency fund goes far beyond that. I am not exactly sure where I read this, but having an emergency fund can change your relationship with work. It can give you the confidence you need to jump ship, to say no, to negotiate. Whereas without the funds sitting your account, you are living paycheck to paycheck and your livelihood depends on your next paycheck, so you are less likely to challenge your employer.

Your emergency fund should be 3-6 months of your monthly expenses. If you work in an industry that is very easy to find jobs in, don’t go crazy with the emergency fund. Also, remember that if you lose your job, you are not going to be spending as usual. Put this fund in a high yield interest savings account that will ensure you maximize your earnings even though it’s not being invested in an S&P account. Do not invest this fund as it is not a long-term savings plan, anything that might be needed on the short run (i.e. less than 5 years) should not be invested in the market.

#8 401 (k)

Having a 401 (k) is so important for your retirement, also because you never want to leave money on the table. Let me explain. Unless you have a pension, your employer likely offers you a match, or a contribution, or both. As an example, if you agree to allocate 5% of your pre-tax income to your 401 (k) retirement account, your employer will match that with another 5%. Sometimes they will offer a contribution regardless of whether or not you contribute. So, ask HR about these matters, and don’t forget to keep an eye on your account to make sure you’re getting the funds in your account. Try to max out on your retirement savings, the IRS changes the limit every year. This is a win-win situation for you, you prepare for your retirement and you save on your taxes when you’re making money the most in your life.

#9 ROTH IRA & BACKDOORING

ROTH IRA is a retirement account that you can put post-tax money in, let it grow tax-free, and then use it after you are 59.5 years old without paying taxes. Amazing, yes, I know. Depending on your total income you are eligible for a maximum of 7500 USD a year with a tax deduction on your yearly income taxes. If your yearly income exceeds the limit (this changes every year), then you’re not completely out of luck. You can still put money aside; however, you will not get a tax deduction on your yearly income taxes, this is called backdooring. But they will still be post-tax funds that will grow tax free and available to you in the same way and it is very much legal.

#10 INVEST YOUR SAVINGS

Once you hit a point where you have checked all the boxes of paying off high interest debt, 401 (k), an emergency fund, and you have savings in your account – well first Congratulations! – and then second, please do not let it sit there doing your bank a favor while earning zero interest. Open a brokerage account and invest that money, or find other ways to invest it.

#11 GET RICH QUICK SCHEMES

Anything advertised as get rich quick, double market investment return… Just stay away from all of them. There are many reasons why Warren Buffet became rich, but one is long haul investment. Nothing good comes easy and quick. Think about the number of people who lost thousands of dollars in the GameStop stock in 2021, my heart hurts when I think about this.

#12 FINANCIAL ADVISOR

Last but certainly not least. Get a financial advisor. They might have different approaches or opinions about how to build wealth and support you, but if you find someone credentialed, you’re most likely in good hands. And just like clinicians, real estate agents, maybe you will have one and then switch to another. They will understand your relationship with money, short- and long-term goals, build a portfolio for you. Financial advisors aren’t just for wealthy people, whoever tells you that – ignore them. I personally do not care about the percentage they make from my earnings, because everyone needs to make a living. If they are working for you, they deserve it.

This blog post was all about how to build wealth. Did I forget to mention something you swear by? Leave a comment below.

As always, thank you so much for stopping by and reading.

See you next week,

Girl on the Upper East Side

If you enjoyed reading this, you might also enjoy How to Buy an Apartment in NYC?

Leave a Reply