Are you traveling to Europe and thinking about shopping there? Or have you been hearing people talk about how they got their VAT refund in Europe after some vacation shopping? Either way you landed on the right page. I’m here to tell you everything you need to know to secure your VAT refund in Europe.

I recently traveled to Europe, and realized that not many people know about the VAT refund in Europe for non-EU citizens. To say that I was shocked is an understatement. I kind of always knew about this I guess from older friends who shopping at big fashion houses in Europe and talked about how much cheaper it was and that they were able to get taxes back. But honestly sales associates in Europe advertise this to tourists, not necessarily just to educate people about this wonderful opportunity but to lure them into buying and buying more while in Europe. So yes, it does surprise me that some people still don’t know about this. But we all learn at some point, so let me share all that I know.

This blog post is everything I know about how to get your VAT Refund in Europe.

I have shopped in several countries while on vacation and have benefited greatly from the VAT refund in Europe. I am going to break this down into steps so it is easy to follow.

#1 Get yourself a credit card with no foreign transaction fees

While this has nothing to do with the VAT refund per se, it is so important. The goal is to maximize savings. You want to benefit from buying in Europe, but you don’t want to end up paying unnecessary fees over each of your transactions. There are many credit cards out there that do not charge you foreign transaction fees, pick one and you’re already off to a good start.

#2 VAT refund rate

You tax refund isn’t 100% of the VAT taxes you paid. The government keeps some and refunds you some. The rate you will receive depends on which country you made your purchases in. If you shopped in Paris, the government keeps 8% and refunds you 12% of the taxes you already paid, as they are included in the price of the item. This is not the case in you are shopping at the airport (duty-free), as the price is already marked down by 12%.

#3 What documents do you need?

You must have your actual passport and credit card (if you want your VAT refund on your credit card that is), in order to have them fill out the paperwork for you at the store. This is a requirement, although in some countries I have seen them accept a picture of your passport’s frontpage on your phone. But as a general rule having your passport with you is best. If you don’t want to carry it with you every day, shop around and put the items you want to buy on hold and purchase them the next day when you have your passport with you.

#4 Before you shop, ask a store associate if they provide VAT refund paperwork

This used to be a big hassle to put together, I think the process has been simplified. More and more stores are now providing tax refund paperwork. From places like fast fashion stores to big fashion houses. But don’t be shy to ask, why not benefit from the VAT deductions.

#5 Paperwork

You’re done shopping in the store, before you pay for your items tell the store associate that you want the tax refund paperwork. Pay with your credit card and then wait for them to fill out the paperwork for you. Take out your passport and give it to them when asked.

#6 How do you want your refund?

You will be asked this question when the form is being filled. The easiest way is to opt for credit card refund. It will come in and automatically reduce your credit card bill. You can also choose cash, just be mindful that there is a processing fee at the airport and sometimes depending on your refund, it might be a good chunk of it. Unfortunately, some stores can only process for a cash refund, so be aware.

#7 Double check

Before you leave the store, make sure your information is listed correctly. Your name, date of birth, passport number and credit card information. If your name and passport are incorrect, even the slightest typo can hinder the process. But in the event where something’s incorrect, hopefully you catch it before heading to the airport, the stores can correct this for you. The only observation I have made over the years is that if the original was printed, the correction cannot be made on the system, they will cancel the form and fill out another form by hand from scratch for you. The exception is big fashion houses. They are able to re-print, but they also rarely make mistakes because of the large sum of money involved.

#8 Different types of forms

Pay close attention to the type of form you were given. On average, (a) 70% of stores will do this on the computer, print it out and hand it to you. (b) The other 20% will fill this by hand and (c) the other 10% will fill it online and send it to your email. The reason why I am going over this, is because it will impact the processing of your tax refund. (a) is the best and easiest to deal with at the airport because it has a barcode and can be scanned without a hassle. More on this in a bit.

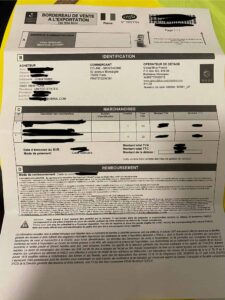

From left to right: Form (a) is the print out form with the barcode on the top right corner, (b) is the hand-filled form with no barcode, and (c) is the form in the emailed version.

#9 Keep items new with tags on

You could be asked to show proof of your purchases as you claim for a tax refund at the airport. So, it is important to not wear those items and keep the tags on, that is if you want your refund. I have seen people wear their new items and get their tax refund. But you could be audited at the airport, which involves showing your item in brand new condition with tags on – if the tags are not on, they are not considered a new purchase. While most people aren’t audited, it could happen to you. Better safe than sorry.

#10 Packing

Make sure you pack your items so they are easily accessible, in case you are asked to show proof at the airport. You don’t want to waste too much time in the process.

The other important piece is to get your paperwork organized. Each store will give you an envelope which includes the tax form and the receipt. Make sure those are where they need to be. If the form was hand filled, do the same. If the form was emailed to you, download it and save it to your phone’s files.

#11 Airport

Once you arrive to the airport, the first thing you need to do before checking your luggage is head to the tax refund area. It is clearly marked, if you ask anyone at the airport, they will tell you where to go. Sometimes there is a long line, especially if you are traveling during high season months. So, to play it safe, dedicate an additional 1-2 hours for this process.

#12 Processing the paperwork

– Your printed forms, will need to be scanned and you will be automatically notified with a green or red signal telling you if the form was accepted. Obviously, green for it’s a go, red means you need to see an agent. Once you are done scanning your printed forms, you will see everything you scanned with document numbers listed on the right of your screen, since there are no receipts, take a snapshot of that screen with your phone (picture below). That’s your proof that you scanned in case there is a problem with your refunds.

– Your hand filled and scanned forms will need the help of the agent sitting behind the desk. You wait in line, share the hand filled forms, they will ask you if you have these items with you in your luggage, you will say yes (of course, only if you actually do!). They might ask you to show them the items. Then, they will give you a stamp of approval (picture below).

– For your emailed documents, pull those forms up on your phone and pass the agent your phone, they are able to scan these on their system.

– Before leaving the area, make sure to drop off all the hand filled stamped forms with their envelopes in the mail box. I take snap shots of the stamped forms with my phone before I drop them in the mail. That is my proof.

– If any of the forms were submitted for cash only refund. Once you get the officers stamp of approval, you will head to another area to get your funds. Do not make cash your choice of refund if given the choice, because there are fees involved. We are trying to maximize returns, if you can why not avoid any extra fees?

On the left: the snapshot taken at the booth after completing the scanning of forms with barcodes. On the right: the form originally hand filled, stamped by customs in Europe, snapshot taken before dropping off in mail box.

#13 US Customs

If you spent more than 800 USD outside the country while on vacation, you need to declare your purchases. The rate for customs tax isn’t pre-determined, it is whatever your agent thinks it’s fair. I believe it is usually not exceeding 5%. I have been so lucky, because each time I have declared, I didn’t have to pay any customs. I was told ‘have a good night, ma’am’. I do think where you land has a lot to do with this. New York City is a bit more relaxed about this, based solely on experience (not statistics).

The companies that handle VAT refunds openly declare that they report back to the customs’ of countries involved. So be aware. I do not think customs has the time and finances to chase down every single person who has made purchases say by two to three thousand dollars. But if you spent more than 5000 USD, just know that they have flagged you and will be waiting for your declaration.

If you do not declare your purchases, and get audited as you are exiting the airport; you will be asked to pay customs and penalty, not just the customs fees that you owed. You will lose your right to self-declare your purchases during future travels. Meaning, every time you land in the US, after you pick up your luggage, they will inspect your bags to see what you have bought and if things were properly declared. That is such a waste of time. I do not want to be on that list.

I have seen several social media influencers get caught with ten designer bags, have those seized at the airport, until the customs and penalty were paid.

#14 Waiting game

Each country has a different time frame for processing the tax refund. Italy and Spain were quite quick, Paris takes 6-8 weeks for the refund to show on your credit card. I have so far never had an issue with refunds not coming through. The Envelope they provide you with the tax form has the company’s information on it. If you are starting to get worried about your refund, you can follow the steps to track it. This is also why taking snapshot of all your forms (scanned, handwritten or email) and saving them is important. While shopping in Italy, my refunds started to show after the tax form was printed in the store – days before my departure date. But I was told I still needed to scan my documents at the airport, because they could reverse those credits. They overall seemed more relaxed about tax refunds than Paris.

This is everything I know about tax refund from my past experiences. How has it been for you? I hope this helps you save some money on your next trip to Europe.

As always, thank you so much for stopping by and reading.

See you next week,

Girl on the Upper East Side

If you enjoyed reading this, you might enjoy these:

[…] I also want to have space for shopping on vacation, especially in Europe – I talked about this in a different blog post. Over the years, during every unpacking I’ve kept record of the things I didn’t use during my […]